3 key financial concepts to understand if you want to be wealthy

3 key financial concepts to understand if you want to be wealthy

One of the self-help money authors who is usually "on the money" is Robert Kiyosaki, author of best-selling personal finance book "Rich Dad, Poor Dad," and "Second Chance: For Your Money, Your Life, And Our World."

One of the self-help money authors who is usually "on the money" is Robert Kiyosaki, author of best-selling personal finance book "Rich Dad, Poor Dad," and "Second Chance: For Your Money, Your Life, And Our World."

"If you understand the meaning of the words cash flow, asset, and liability, your chances for a richer life are greatly improved. The reason most people struggle financially is because they have lots of cash flowing out — and very little flowing in."

The 3 big things to understand are:

Asset: an asset as something that "has value, produces income or appreciates, and has a ready market. Assets put money in your pocket." Assets increase in value. Something which is virtually guaranteed to decrease in value, such as a car, can rarely be called an asset in investment terms.

Liability: a liability is something that costs money instead of generating money or value. Debts are obvious, but commitments which will take future cashflow even if they aren't a debt yet (such as "interest free" periods for hire purchase) are liabilities too.

Cash flow: Cash flow is simply the balance of revenue (income) and expenses. More income than expenses is positive, less income than expenses is negative. Positive cash flow creates assets.

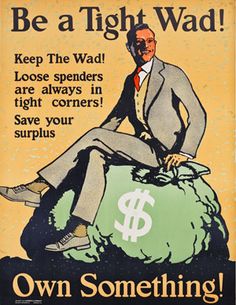

The wealthy do everything they can to keep cash flow positive, as that is what buys assets and gets rid of liabilities. Do this well enough and the assets themselves start producing additional revenue, strengthening cash flow even more.

THAT is why the rich get richer.

- Last updated on .