Spot The Future Oil Price

I was asked recently "I keep hearing about the Oil Spot Price. I know that's not how much I pay for petrol but just exactly what is it?

The Spot Price of Oil (or anything else) is the price at which you can buy and have delivered a barrel of crude oil right now. It's the number the media tend to concentrate on. But most oil is actually traded on futures markets where oil is actually bought and sold before it even comes out of the ground.

The Spot Price of Oil (or anything else) is the price at which you can buy and have delivered a barrel of crude oil right now. It's the number the media tend to concentrate on. But most oil is actually traded on futures markets where oil is actually bought and sold before it even comes out of the ground.

These days even many regular consumers like you and I are likely to engage in a little bit of forward oil contracting. If I'm going to drive to Christchurch next week and the petrol station is having a 10c off day I'll probably fill my car's tank even though I'm not going to use it all before I drive all the way to Christchurch.

An indication of what the companies (and speculators) are thinking prices will do can be gained by looking at the futures markets. That tells us how much people are prepared to pay for oil delivered in the future.

At the moment you can buy a futures contract to deliver a barrel of West Texas Light Crude Oil in March 2015 for $USD48.88, if you want to lock in a price for the barrel you'll need in December 2015 it will cost you $US58.00, but if you want to lock in a price for December 2022 it will cost you $US71.59. You could buy it now and store it till then but then you have to have the storage facilities and all the associated costs. And you wouldn't be able to use your swimming pool for a while.

Of course the spot price helps determine the futures prices, there are companies who just buy and store oil, ther are oil tankers, the big ships, that are just floating around waiting for a buyer. And the really big users have storage. If its cheaper to buy it now and store it than it is to enter into a contract to have it delivered in the future then it makes sense to do so. There are probably people builiding storage facilities as I write this.

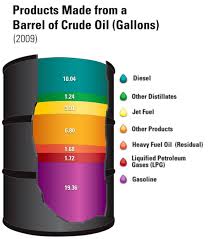

People tend to complain when they hear on the news that the price of oil has gone down and expect that price fall to be reflected in the price of their petrol tomorrow but it simply doesn't work like that. There are a couple of steps and a period of time between a barrel of oil being sold by the people who pumped it out of the ground and it being pumped into your car. It has to be transported to the refinery to be turned into petrol and then it has to be transported to the petrol stations so it can be pumped into your car

Petrol companies can pay the spot price if they want to but like most businesses they want to try to maximise their profits. Part of the equation is to make sure that they have enough oil to make enough petrol to sell at a profit and they so they'll juggle their supplies to try and ensure that happens. They do this by ordering their supplies ahead and use the futures markets to buy oil in the future at a price set now. This helps them ensure they will have sufficient supplies and know how much they are paying for most, if not all of it.

All that oil/petrol in transport and in storage wasn't paid for at todays price, it may have been bought weeks, months or even years in the past.

If the petrol company thinks prices are likely to be lower in the future they may buy less on the forward market and more on the spot market. And of course if they expect prices to rise then they will buy more on the forward market at todays prices.

Think of an airline, they use a lot of fuel, they schedule thousands of flights a day for years in advance. People book and pay for flights in advance, the airline can't say, " ... we've put up the price of that ticket you've already paid for because oil prices have gone up". So the airlines need to juggle the price they are paying for their fuel, don't pay the spot price. They use forwared contracts and the futures markets to minimise their cost and ensure continuity of supply.

They might have contracts in place saying "deliver me 50,000 gallons of aviation fuel each Monday for the next 6 months and I'll pay you $US3.50 a gallon, and then another for the following six months they may only contract for 25,000 gallons at US3.50. Because they think they'll be able to get the other 50,000 gallons cheaper later. It is far from that simple of course. Big airlines have teams of full time staff just looking at their fuel supplies, how much they'll use and how much they are likely to have to pay for it. Juggling many many contracts at different prices and dates to ensure continuity of supply at the cheapest price they can.

We are starting to hear people saying oil can't stay cheap for long how can I take advantage? There are various financial instruments that you and I can use to try and make money based on the movements in oil prices, and there has been an upsurge in interest lately. But beware, some can cost you an awful lot of money very, very, quickly. Make sure you do your research first and if you'd like to discuss the options available to you give us a call on 07 578 3863.

For an interesting article on the history of oil prices and how they are determined click here.

- Last updated on .